At Econetix, we believe that sustainability and growth go hand-in-hand. This newsletter explores how the carbon market works, why it matters, and how businesses can leverage it to create social, environmental and financial impact.

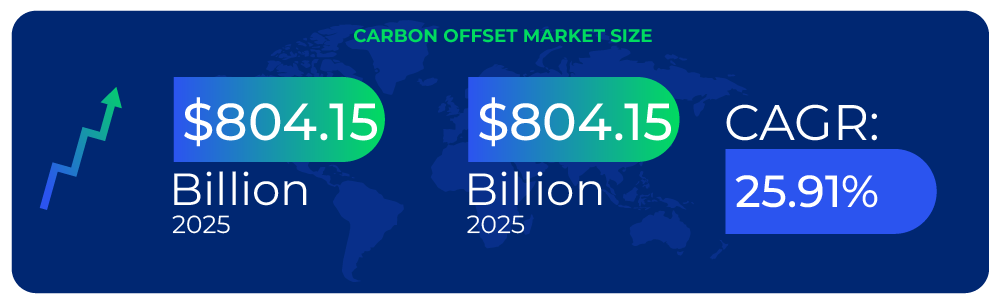

Carbon Market’s Rapid Growth

The carbon market is evolving faster than ever. With global emissions targets tightening and companies under increasing pressure to achieve net-zero, carbon credits and verified removal projects have become not just environmental tools, but strategic business assets.

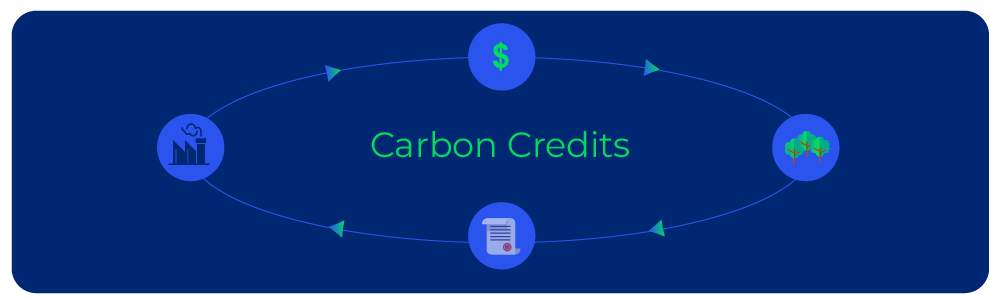

The carbon market allows companies to buy, sell, and trade carbon credits to offset their emissions. These credits are generated from verified projects that remove or reduce greenhouse gases — from reforestation to regenerative agriculture and direct air capture. Carbon credits are no longer optional — they’re becoming essential to compliance, ESG performance, and investor confidence.

The voluntary carbon market is driven by corporate net-zero commitments. Nature-based solutions account for the majority of carbon removals, offering co-benefits like biodiversity and water protection. Investors are increasingly using carbon portfolios as a way to hedge climate-related risks while generating measurable impact.

Data Source: Global Growth Insight

In 2025, Microsoft alone accounted for about 80% of all credits purchased from technology-based carbon removal projects (Financial Times). Oil and Gas companies like Shell were the largest purchasers of carbon credits in 2024, using 14.1 million credits.

The carbon trading market currently stands at an estimated size of 595.8 billion USD and is projected to reach 804.15 billion USD toward the end of this year. The carbon offset market today is considered to be in its infancy with potential for rapid growth in the coming years.

New Benefits and Opportunities in the Carbon Offset Market

Companies engaging in carbon markets gain brand credibility through contributions toward society, with their verified climate actions strengthening their ESG credentials. Carbon offsets can be monetized or integrated into sustainability offerings.

Transparent reporting on carbon offsets and monitoring emissions drives efficiency and innovation, attracting forward-looking investment.

Carbon offsets are emerging as a new asset class, creating opportunities where companies can profit from price differences, futures contracts and structured deals. Companies with strong carbon portfolios can sell surplus credits for revenue if they reduce emissions faster than required.

Carbon credits give firms a financial hedge — they can balance short-term emissions with purchases while planning long-term decarbonization. It is often cheaper to finance external reduction/removal projects than to invest immediately in expensive technologies.

The Social Impact

Carbon offset projects have delivered measurable social co-benefits alongside emission reductions. For example, improved cookstove programs in Kenya cut household wood use by more than half, saving women and children up to 2 hours per day — equivalent to 91 working days a year — while reducing smoke-related health problems.

In Bangladesh, the World Bank’s Improved Cookstove Program provided 3.4 million people with clean stoves, created 3,000 local jobs, saved 5.34 million tons of biomass annually, and reduced 4.14 million tons of CO₂ per year.

Forest-based offset projects have also supported indigenous livelihoods. A 14-year study in Panama found that payments for carbon offsets enabled communities to diversify incomes and continue reforestation even after payments ended.

Econetix’s Role in the Carbon Market

Econetix-owned Solar Projects

Econetix helps businesses navigate the carbon market through data-driven project selection and monitoring. Our verified carbon removal credits and transparent reporting help organizations meet compliance, investor expectations and customer trust.

Through dMRV (digital Measurement, Reporting and Verification), we use a systematic approach to measure climate mitigation accurately. With mangrove, reforestation and renewable energy projects active in over 8 countries, we are committed to removing over 1 billion tons of CO₂.

The carbon market isn’t just about compliance — it’s about leadership, innovation and growth. Partner with Econetix to turn your sustainability commitments into measurable impact.

Related Articles